Some financial experts have supported the Federal Government proposal to tax additional wealthy Nigerians, describing it as a means of income redistribution that can enhance the country’s fiscal revenues.

They said this in separate interviews with the News Agency of Nigeria (NAN) on Friday in Lagos.

The Chief Executive Officer, Center for the Promotion of Private Enterprise, CPPE, Dr Muda Yusuf, said the government proposal was welcome idea.

“This approach is a form of progressive tax, because high network individuals are expected to pay more taxes.

“It is a means of income redistribution and a common practice in most civilised countries where there is economic development,” Yusuf said.

He condemned a situation where wealthy citizens do not remit the right percentages of taxes to appreciate government authorities.

“Their tax remittance is not commensurate to their networth and affluence lifestyle. They often short-change the government,” Yusuf said.

In his view, a former President, Chartered Institute of Taxation of Nigeria, CITAN, Dr Mc-antony Dike, described the government proposal to tax more wealthy citizen as constitutional.

Dike said, “Our tax laws dictate that every Nigerian who earn an income whether legitimately or otherwise must pay their tax.

“Indeed the Personal Income Tax Act 2011, as amended, removed the exemptions it granted to the president of the Federal Republic of Nigeria”, adding anybody who earn legitimate income legitimately or must pay tax.”

He noted that rich Nigerians who do not pay tax were denying government the revenue to provide public utilities for the citizen.

“As a matter of fact, a country like South Africa has demonstrated greater tax compliance culture, than we have in Nigeria.

“Indeed, before the advent of Value Added Tax in South Africa in the late 1990s, personal income tax is contributing close to 60 per cent of total tax collection in that country,” Dike said.

Also, the President Standard Shareholders Association of Nigeria, Godwin Anono, said the federal government proposal to tax more wealthy Nigerians was a novel initiative.

“The planned policy is a sort of reduction of economic inequality in our society.

“Where the elite are expected to take care of the economically vulnerable citizen through its taxes,” Mr Anono said.

He advised that the federal government should employ technology to bring more eligiable tax payers into the tax net.

NAN reports that The Federal Government has stated its plan to begin taxing wealthy Nigerians to achieve its 18 per cent Tax-GDP ratio revenue target.

This was disclosed by Taiwo Oyedele, Chairman, of the Presidential Committee on Fiscal Policy and Tax refrorms.

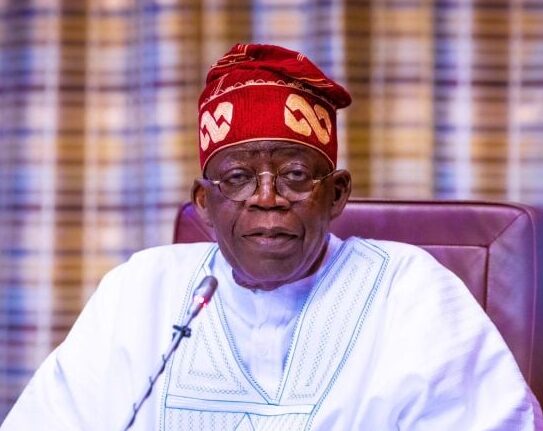

Mr Taiwo noted that the move was part of President Bola Tinubu’s reforms as the federal government’s aims to achieve an 18 per cent Tax-to-GDP ratio within three years.

According to him, the plan is to enable the rich pay more tax in favour of the less-priviledged.

Mr Taiwo also envisage a reduction in the corporate income tax rate below the current rate of more than 40 per cent to help boost business.

NAN